Typical Australian borrowers could see their monthly mortgage repayments climb by a third or $721 during the next 18 months, National Australia Bank predicts.

A surge home loan pain would also see Australian borrowers lumped with the tightest budget pressures in a decade.

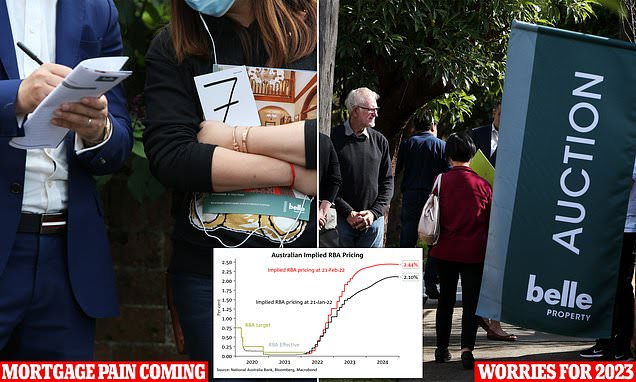

NAB is predicting mortgage rates will climb by 2.25 percentage points by September 2023, which would see someone paying off a typical $600,000 Australian home loan owe another $700 a month to their bank.

NAB’s director of economics Tapas Strickland said interest payments as a share of household income would rise to the highest level since September 2012.

He predicted interest payments, across all borrowers, climbing to 7.9 per cent of household income, up from 4.4 per cent now.

That would see mortgage repayments as a proportion of take-home pay climb above the post-Global Financial Crisis average of 7 per cent and well above the pre-pandemic level of 5.7 per cent.

‘While it is clear the household sector will be able to service a higher mortgage rate, a rise in interest payments relative to income of 3.5 percentage points will have to be financed by a reduction in saving and/or lower consumption than otherwise unless the economy remains very strong and wages growth accelerates considerably,’ Mr Strickland said.

In January, Australia’s median property price stood at $718,146, following a 22.4 per cent annual increase which was the fastest pace in 32 years, CoreLogic data showed.

Home prices in capital cities and regional areas are also growing at ten times the level of wages.

With a 20 per cent deposit factored in, a borrower paying off a typical Australian home would owe the bank $574,517.

An owner-occupier with this kind of mortgage, with a still-low 2.39 per cent variable rate, would now have monthly repayments of $2,238.

NAB is predicting a 2.25 percentage point increase in mortgage rates by September 2023, based on financial market pricing for moves in the Reserve Bank cash rate, with the modelling assuming banks raise their lending rates accordingly.

Should variable rates rise to 4.64 per cent, as predicted, monthly repayments on a mid-priced Australian home would climb by $721 to $2,959, marking 32 per cent increase in just 18 months.

Such an increase would also affect borrowers who fixed their mortgage rates at historically low levels in 2021 for two years.

Wages in 2021, however, grew by just 2.3 per cent even though skilled migrants were banned from moving to Australia until December, with pay level growth stuck below the long-term average of 3 per cent since mid-2013.

Private sector wages grew by 2.4 per cent compared with 2.1 per cent for public sector employees, new Australian Bureau of Statistics for the December quarter released on Wednesday showed.

KPMG senior economist Sarah Hunter said the latest wages growth data was still below the RBA’s preferred level before it raised rates.

Wages are also well below the inflation rate of 3.5 per cent.

‘At the moment the average worker is experiencing declining real wages,’ Ms Hunter said.

‘Although markets expect tightening to begin imminently, momentum in wage setting and price inflation means we expect the RBA to wait until the second half of the year August or possibly later, in the fourth quarter, before pulling the trigger.’

The Reserve Bank of Australia cut the cash rate to a record-low of 0.1 per cent in November 2020, following the national Covid lockdowns, and Governor Philip Lowe last year repeatedly promised to leave it there until 2024 at the earliest.

But NAB is predicting rates will rise later this year, to hit 0.5 per cent by the end of 2022 and 0.75 per cent by the March quarter of 2023.

Even with rates at low levels, an average, full-time earner on a $90,329 salary with a $574,517 loan already has a debt-to-income ratio of 6.4.

The Australian Prudential Regulation Authority considers six to be a dangerous level where a borrower would struggle to pay their mortgage and bills.